1-What do you think about battery technologies in electric vehicles and future trends?

First of all we want to emphasize the fact that we strongly believe that all current battery technologies have to be taken into account when talking about decarbonisation of transport (EVs and all forms of hybrid). Future demand and battery applications are expected to strongly grow the next couple of decades and we will all need all battery technologies in order to help decarbonisation mobility and transport in Europe. Specifically for e-mobility, these will be predominantly lithium batteries as traction batteries, as well as lead batteries for functional safety.

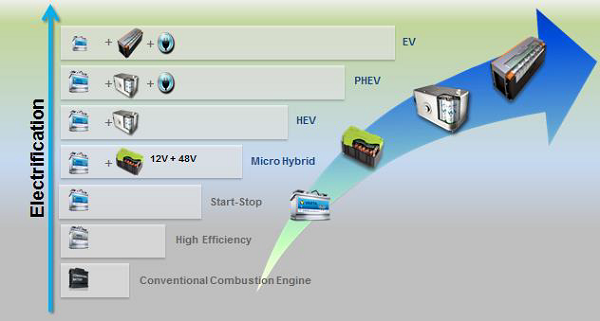

Today we can identify the following phases of electrification: from start/stop (micro-hybrid) to 48Volt (mild hybrids), hybrids, plug-in hybrids and full EV.

- “start/stop vehicles” are equipped with an advanced lead acid battery where internal combustion engine is shut off during braking and rest.

- “Mild hybrids” have on board on top of the 12V lead acid battery a 48V lithium ion battery which stores energy while breaking which is then used to boost the vehicle’s acceleration and/or power certain functions of the ICE such brakes, steering or air-conditioning. And as such makes the ICE more efficient and reducing CO2 emissions.

- In hybrid vehicles (HVEs), the ICE is linked to a lithium battery, allowing for a certain range of “emission-free” driving. The battery is constantly recharged during driving.

- Plug in Hybrids (PHEVs) have on top of the ICE, a larger battery which can be charged externally and as such allow long distances of e-driving.

- Finally, the full Electric Vehicles (Evs) no longer have an ICE and only the battery “drives” the vehicle and needs regular external charging. Both PHEVs and Evs have lithium-ion batteries on board.

In terms of future technologies, as said we will have to continue developing all technologies, depending on the application as long as they will help reducing CO2 emissions. Specifically for Evs, for sure lithium is and will be the technology of the coming years for the traction battery.

According to the Joint Research Centre form the European Commission, we are currently in “phase 2 A and B”- with lithium ion batteries, where as of 2020 Phase 3 “Optimised Lithium-ion batteries well be introduced. The biggest change however will come as of 2025 with the arrival of the new cells generation such as the solid state lithium batteries and Lithium/air batteries in 2030.

2-What kind of infrastructure preparations do EU countries make? Which technologies do they prefer?

We as an assocation have no clear view on this, but we can however refer to the recent initiatives of the EU Policy Makers.

With the launch of the EC’s 'European Battery Alliance’ in 2017 and the “Battery Action Plan” from 2018, the policy makers really put batteries on the agenda! The Battery Action Plan consists of a number of key elements: (source EU Commission)

- secure access to raw materials from resource-rich countries outside the EU, facilitate access to European sources of raw materials, as well as accessing secondary raw materials through recycling in a circular economy of batteries;

- support European battery cells manufacturing at scale and a full competitive value chain in Europe: bringing key industry players and national and regional authorities together; working in partnership with Member States and the European Investment Bank to support innovative manufacturing projects with a important cross-border and sustainability dimensions throughout the battery value chain;

- strengthen industrial leadership through stepped-up EU research and innovation support to advanced (e.g. Lithium-ion) and disruptive (e.g. solid state) technologies in the batteries sector. This should target support in all the steps of the value chain (advanced materials, new chemistries, manufacturing processes, battery management systems, recyling, business model innovations), be closely integrated with the industrial ecosystem and contribute to accelerating the deployment and industrialisation of innovations;

- develop and strengthen a highly skilled workforce in all parts of the battery value chain in order to close the skills gap through actions at EU and Member State level providing adequate training, re-skilling and upskilling, and making Europe an attractive location for world class experts in batteries development and production;

- support the sustainability of EU battery cell manufacturing industry with the lowest environmental footprint possible, for example by using renewable energy in the production process. This objective should be notably implemented through setting out requirements for safe and sustainable batteries production;

The Battery Alliance was launched by the EU Commission in the end of 2017 as it recognised the lack of a domestic, European cell manufacturing base which jeopardises the position of EU industrial customers because of the security of the supply chain, increased costs due to transportation, time delays, weaker quality control or limitations on the design.So, the EU needed to act fast - and collectively - to overcome this competitive disadvantage and capitalise on our leadership in many sectors of the battery value chain, from materials to system integration and recycling.

Europe’s metals and batteries industries, including EUROBAT, strongly support the European Commission’s Battery Alliance objectives. Our sectors are integral to supplying, producing and recycling Europe’s battery technologies. We are committed to establish world-leading batteries value chains in Europe. To support that ambition, we encourage the European Commission to ensure its Batteries Alliance and Chemicals Management objectives are aligned. Several metals (including cobalt compounds, lead and lead compounds, cadmium and cadmium compounds, nickel and nickel compounds etc) used in batteries are subject to review under the EU REACH Regulation (EC 1907/2006), due to their hazardous properties. We are concerned that options to further restrict or even prohibit these substances would disrupt Europe’s battery value chains, without added environmental protection.

The EU policy makers have recently confirmed that although lithium is the main technology for e- mobility, they want to consider all battery technologies but as long as they contribute to decarbonisation of transport and mobility.

3-We’ll also appreaciate if you could share information regarding automotive technologies (brand-independent)

Purely related to battery technology we see an increased performance level of lead batteries and cost reduction, mainly applied in “micro hybrids”/start – stop batteries. Lithium ion technology will further focus on increasing energy and power density, while lowering costs and improving recycling efficiency. Latest cell technology and solid-state lithium will probably lead to an overall breakthrough in 10Y form now and phasing out its current challenges.

4-What is EU’s market share targets for 2019?

Last year the EU Commission has published its 2030 C02 targets: CO2 level of an OEM’s fleet of new cars has to be 37,5% less versus today. In order to achieve this, 35% of the newly sold cars must be EV/hybrid/hydrogen-powered.